The VCC open Asia’s gateway for Singapore as a global domicile for fund managers and investors by growing the opportunities for both domiciliation and operation of funds and leveraging Singapore’s position as a financial hub. ASCENT is a Global Fund Administrator that provides one stop solution for VCC. To know more about VCC , please visit https://ascentfundservices.com/variable-capital-company-vcc-the-game-changer/

Key Features of VCC

- A VCC has a variable capital structure that provides flexibility in the issuance and redemption of its shares. It can also pay dividends out of capital, which gives fund managers flexibility to meet dividend payment obligations.

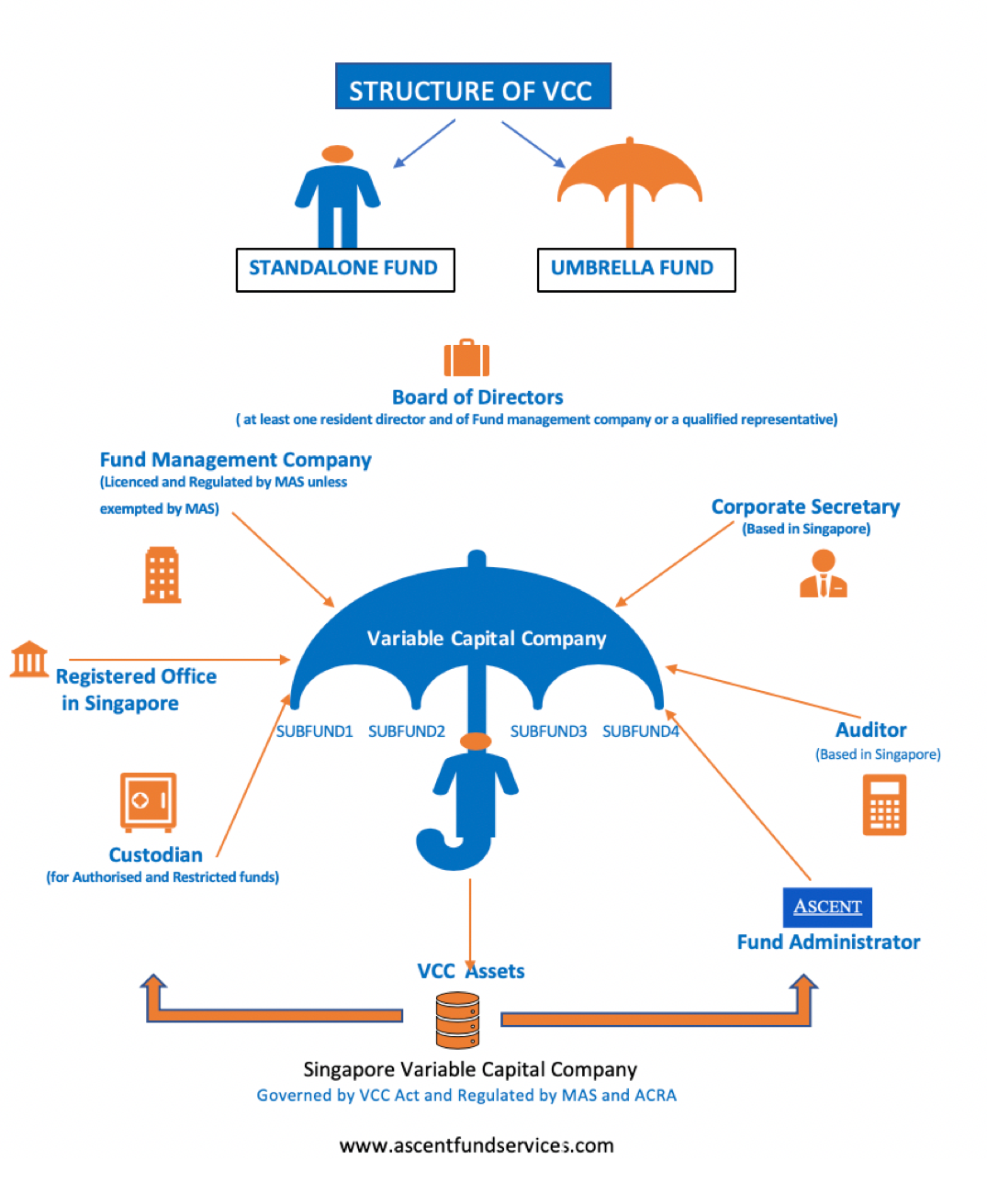

- A VCC can be set up as a single standalone fund or an umbrella fund with two or more sub-funds, each holding a portfolio of segregated assets and liabilities. For fund managers that structure their funds as umbrella VCCs, there may be cost efficiencies from using common service providers across the umbrella and its sub-funds.

- A VCC can be used for both open-ended and closed-end fund strategies.

- Fund managers may incorporate new VCCs or re-domicile their existing overseas investment funds with comparable structures by transferring their registration to Singapore as VCCs.

- VCCs must maintain a register of shareholders, which need not be made public. However, this register must be disclosed to public authorities upon request for regulatory, supervisory and law enforcement purposes.

Basic requirements to incorporate a new VCC

- The proposed VCC name, financial year end information, particulars of proposed VCC officers, registered office, constitution of the proposed VCC and the declarations/ endorsements where applicable;

- At least one director who is ordinarily resident in Singapore. This means that Singapore citizens, Permanent residents or holders of Enter Pass/Employment Pass (subject to Ministry of Manpower’s letter of consent), with a local residential address may qualify;

- At least one director (who may be the same person as in point 2) who is either a Qualified Representative (as defined under the Variable Capital Companies Act) or a director of the manager of the proposed VCC

- A manager which is a Permissible Fund Manager must be appointed to manage the proposed VCC

- Payment of the prescribed incorporation fee.

(refer to Annex A below for ACRA fee and FAQs)

www.theascent-group.com

Corporate Secretarial

Appointment of Company Secretary

Must appoint at least 1 company secretary within 6 months of incorporation.

Registration of sub-fund

A sub-fund is required to be registered within 7 days of formation. There will be a separate name and registration number for each sub-fund.

Annual Return

A VCC needs to lodge its Annual Return within 7 months after the end of its financial year.

Certificate of Residency (“COR”)

- VCC that are tax residents in Singapore will be eligible to access Singapore tax treaties.

- In the case of an umbrella VCC, the COR will be issued in the name of the VCC, with the name of the relevant sub-funds included in the COR.

- the VCC and its relevant sub-funds should be able to access the tax treaties entered into by Singapore.

Share and Share Capital

A VCC will be allowed to freely redeem shares and pay dividends using its capital. This is one of the main advantages of a VCC. The constitution of a VCC would be deemed to imply the following:

- the value of the paid-up share capital shall be at all times equal to the NAV of the VCC

- subject to adjustments for fees and charges as provided in the constitution of the VCC, the shares of the VCC shall be issued, redeemed or repurchased at the price equal to the proportion of the NAV of the VCC represented by each share.

- an exception is available for closed-end funds which are listed on a securities exchange where the shares of the fund may be traded.

Ring-fencing of sub-funds

- VCC can be established as an umbrella structure with several sub-funds.

- Each sub-fund must be registered with the ACRA.

- The VCC must keep segregated the assets and liabilities of each sub-fund and the assets of one sub-fund may not be used to discharge the liabilities of another sub-fund.

- A fund manager may not wind-up a sub-fund at its own discretion but a VCC may do so using the procedures applicable under the Companies Act read with the Bankruptcy Act (or the Insolvency, Restructuring and Dissolution Act 2018, when it comes into force) for the winding up of companies as applied to the sub-fund. A sub-fund will therefore be wound up singly and separately from the other sub-funds as if it were a separate legal entity. This will ensure that the ring-fencing of each sub-fund’s assets

Corporate Governance

A VCC must have at least one director who is ordinarily resident in Singapore. At least one director of the VCC must also be a director or qualified representative of the VCC’s fund manager.

A VCC is required to have its,

- at least one Singapore-resident director

- registered office in Singapore

- Singapore-resident Company Secretary.

These requirements, coupled with the fact that the day-to-day fund management would carried by Singapore based MAS regulated fund managers, would lend to VCCs having Singapore economic substance.

Auditor

Must appoint an auditor within 3 months after incorporation, unless the company is exempt from audit requirements.

Accounting standards

VCC are allowed to prepare their financial statements using,

- the Singapore Financial Reporting Standards (SFRS)

- the International Financial Reporting Standards (IFRS)

- US Generally Accepted Accounting Principles (US GAAP).

- In this regard, VCC are different to existing Singapore Unit Trust structures, which require the RAP 7 (Recommended Accounting Practice 7) framework to be used. The RAP 7 framework has certain differences to IFRS, is not well known or understood outside Singapore, and is considered inflexible in its disclosures.

Requirement for Annual General Meeting (AGM)

AGM must be held at the end of a financial year within 6 months.

However, a VCC need not hold an AGM if:

- its directors give at least 60 days’ written notice to the members before the last date on which the AGM must be held; or

- the VCC has sent to all persons entitled to receive notice of general meetings a copy of the financial statements, or copies of the consolidated financial statements and balance sheet, relating to the relevant financial year, and accompanied by the auditor’s report on them, no later than 5 months after the end of the financial year.

However, one or more members with 10% or more of the total voting rights may by notice to the VCC require the AGM to be held.

Tax matters

A VCC is treated as a company and a single entity for tax purposes. This means that only one set of income tax returns is required to be filed with the Inland Revenue Authority of Singapore (IRAS).

Tax exemptions

- VCC is treated as a company for corporate income tax purposes.

- An umbrella VCC only file single corporate income tax with Inland Revenue Authority of Singapore (“IRAS”) regardless of the number of sub-funds.

- Deduction and allowances for expenses incurred by umbrella VCC will be applied at the sub-fund level to determine the sub-fund’s chargeable income.

- VCC enjoy tax exemptions on qualifying investment income under section 13R and 13X of Income Tax Act.

Stamp duty

Stamp Duty is levied at the sub-fund level. This treatment is consistent with the principle that sub-funds have segregated assets and liabilities.

Goods and Services Tax (GST)

Goods and Services Tax (GST) will apply at sub-fund level as each sub-fund makes independent sale and purchase decisions on its respective investment mandate. Each sub-fund that is liable for GST registration is to perform GST accounting and reporting separately.

Double taxation treaties

VCCs are also expected to have access to Singapore’s network of over 80 double taxation treaties. VCCs can apply for a certificate of residence from IRAS. IRAS will detail the name of the VCC and all sub-funds receiving income from the source jurisdiction in such certificate. Whether the VCC is ultimately able to benefit from the tax treaties would depend on the specific tax treaty, and tax advice will need to be sought.

Foreign CIS converting to Singapore VCCs

- Foreign corporate funds (e.g. a Cayman segregated portfolio company or a BVI protected cell company) may redomicile to a VCC,

- Foreign corporate funds have positive net assets and remain solvent within 12 months from the date of application.

- The applicant must submit the requisite forms and documentation for inward re-domiciliation.

VCC Grant Scheme

www.ascentfundservices.com

- The grant scheme will help defray costs involved in incorporating or registering a VCC by co-funding up to 70% of eligible expenses paid to Singapore-based service providers. The grant is capped at S$150,000 for each application, with a maximum of three VCCs per fund manager.

- The grant scheme will be funded by the Financial Sector Development Fund (FSDF) administered by MAS and take effect today for a period of up to three years.

- Applications for the grant are to be made directly by the fund manager to MAS.

- The scheme will run from 16 January 2020 to 15 January 2023.

How ASCENT as a Global Fund Administrator will be your partner is VCC Journey?

ASCENT as independent Global Fund Administrator provides one stop solution for all VCC related wide range of offerings like,

- Incorporation of VCC

- Corporate Solution (Corporate Secretarial, GST filing, Corporate Accounting, Tax filing, etc)

- NAV Calculation and Portfolio accounting

- Investor services include AML and KYC

- FATCA and CRS full services

- Financial statement preparations

- US Tax (K1) if required

For our detailed products offering,

https://ascentfundservices.com/fund-administration/#nav_calculation_and_portfolio_accounting

For more details on VCC, please contact us on sales@ascentfunds.sg

ANNEXURE A

ACRA fees for VCC

Statutory Filing Fees

VCC name reservation – S$15

Application for incorporation of VCC – S$8,000

Registration of Sub-Fund – S$400

Application for transfer of registration – S$9,000 + S$400 (sub-fund registration fee) x number of sub-funds.

Processing time for application

It will usually take up to 14 days to process an application form (except for Transfer of Registration which may take up to 60 days) from the date of submission of all required documentation. If referral to another government agency is required, it may take up to 60 days processing time.

Frequently Asked Questions (FAQ’s)

Who can incorporate/register a CSP?

The incorporation/registration of a new VCC can be lodged with ACRA by a Corporate Service Provider (CSP) or by a subscriber to the constitution of the proposed VCC. A subscriber can be either an individual or corporate entity that subscribes to the shares of the proposed VCC.

Must a VCC obtain approval from MAS first before submitting an application to ACRA, and how long will this take?

No, a VCC need not seek approval from MAS prior to incorporation. However, the existing requirements for offers of units in a CIS to persons in Singapore will apply to VCCs under the Securities and Futures Act (Cap. 289).

More details can be found on http://www.mas.gov.sg/regulation/capital-markets/offers-of-collective-investment-schemes.

What is the minimum number of directors required of a VCC?

A VCC must have:

- At least one director who is ordinarily resident in Singapore. This means that Singapore citizens, Permanent residents or holders of EntrePass/ Employment Pass (subject to Ministry of Manpower’s letter of consent), with a local residential address may qualify. FIN holders are advised to seek consent from the relevant pass issuing authority (e.g. MOM/ICA) before registering or taking on appointment (e.g. Director, Secretary) in an entity;

- At least one director (who may be the same person as in above) who is either a Qualified Representative (as defined under the Variable Capital Companies Act) or a director of the VCC’s fund manager.

What is the requirement for being a VCC director?

He/she must be:

(a) At least 18 years old;

(b) Of legal capacity;

(c) A fit and proper person. The factors in determining whether a person is a fit and proper person to act as a director of a VCC are prescribed under the Variable Capital Companies Regulations 2020; and

(d) Not disqualified from acting as a director of a VCC, e.g. an undischarged bankrupt

What are the requirements of the VCC’s fund manager?

A VCC must appoint a Permissible Fund Manager to manage its property or operate the CIS that comprise the VCC. A Permissible Fund Manager refers to:

(a) A licensed fund management company which holds a capital markets services licence for fund management under the Securities and Futures Act;

(b) a registered fund management company which is registered under paragraph 5(1)(i) of the Second Schedule to the Securities and Futures (Licensing and Conduct of Business) Regulations

(c) a financial institution exempted under sections 99(1)(a), (b), (c) or (d) of the Securities and Futures Act from the requirement to hold a capital markets services licence to carry on business in fund management, i.e. a bank licensed under the Banking Act (Cap. 19), a merchant bank approved under the MAS Act (Cap. 186), a finance company licensed under the Finance Companies Act (Cap. 108) or a company or co-operative society licensed under the Insurance Act (Cap. 142).

Can any overseas fund re-domicile in Singapore as a VCC?

Only overseas funds that adopt a corporate structure that is equivalent to a VCC may re-domicile as VCCs in Singapore. Fund managers of such funds can do so by registering the VCC (and sub-funds) with ACRA, and notify the foreign authorities of the de-registration accordingly.

What are the basic requirements required for foreign corporate entities to re-domicile into Singapore as VCCs?

The basic requirements for foreign corporate entities (FCE) to apply for re-domiciliation (i.e. Transfer of Registration) into Singapore are as follows:

- The proposed VCC name, particulars of proposed VCC officers, registered office;

- At least one director who is ordinarily resident in Singapore. This means that Singapore citizens, Permanent residents or holders of EntrePass/ Employment Pass (subject to Ministry of Manpower’s letter of consent), with a local residential address may qualify;

- A director (who may be the same person as in 7(b) above) who is either a Qualified Representative (as defined under the Variable Capital Companies Act) or a director of the manager of the proposed VCC;

- A manager which is a Permissible Fund Manager must be appointed to manage the proposed VCC;

- Financial year end information, such as the proposed VCC’s intended date of first financial year end after transfer of registration, which cannot be more than 18 months from the FCE’s last FYE date. If the proposed VCC wish to have a first financial year of longer than 18 months, the proposed VCC has to separately apply to the Registrar for a ‘Change in Financial Year End’ after successful Transfer of Registration;

- Constitution of the proposed VCC;

- A certified copy of the charter, statute, constitution or memorandum or articles or other instrument constituting or defining its constitution (if any), in its place of incorporation;

- A certified copy of the certificate of incorporation of the FCE in its place of incorporation; or a document of similar effect to the certificate of incorporation of the FCE in its place of incorporation;

- Where the FCE consists of two or more collective investment schemes, certified copy of the document of registration of each collective investment scheme of the FCE in its place of incorporation; or a document of similar effect to the document of registration of each collective investment scheme of the foreign corporate in its place of incorporation;

- Declarations/ endorsements where applicable;

- Payment of the prescribed fee.

Is there a model constitution for VCC?

The Singapore Academy of Law (SAL) has published a set of guidelines and two model constitutions, one for open-ended VCCs and another for closed-end VCCs.

These are available on SAL’s website at http://singaporelawwatch.sg/About-Singapore-Law/VCC-Model-Constitutions for reference and/or customised for use as necessary.

What is the format for VCC UEN and the sub-fund number? How can we identify that the sub-funds come from the same VCC/”umbrella”? What is the maximum number of sub-funds a VCC can have?

VCC UEN format is TYYVCXXXXX, e.g. T20VC0001A.

For umbrella VCCs, the sub-fund number format is TYYVCXXXXX-SFXXX.

e.g. T20VC0001A-SF001 (where SF-001 is the first sub-fund)

e.g. T20VC0001A-SF002 (where SF-002 is the second sub-fund)

Note that non-umbrella VCCs do not have any sub-funds.

What are the available information products and the associated fees?

Free business profile will be issued to the lodger/applicant upon successful incorporation or transfer by registration of VCC or filing of annual return.

Certificate Confirming Transfer by Registration of VCC will also be issued free-of-charge to the lodger upon successful registration.

- Available information products which are chargeable at a fee include the following: Business Profile (e-certified version) at $5.50

- Certificate Confirming Incorporation of VCC at $50

- Extract of Filings at

- $11/form

- $26/form and attachment

- $1/certification page

Note that other available products such as other certificates, people profile and registers will be launched by subsequent phases. Please re-visit this page for further updates.

In addition, the following documents are not made available to any member of the public:

- Constitution

- Annual Return

Do VCCs need to maintain a list of beneficial owners or controllers?

VCCs are required under their AML/CFT Notice to maintain a register of beneficial owners of VCC (which is akin to the concept of controllers). Please see paragraph 7.17 of MAS Notice VCC-N01.

Frequently asked questions sourced https://www.acra.gov.sg/business-entities/variable-capital-companies/faqs